Companies need money for their activities. Some companies require taking out loans to finance expenses and activities in particular that will lead to profitability. Thus, monitoring the amortization of your loan is necessary so that you do not miss a payment. If you don’t understand how loan amortization is calculated, you should ask for some details of your lender.

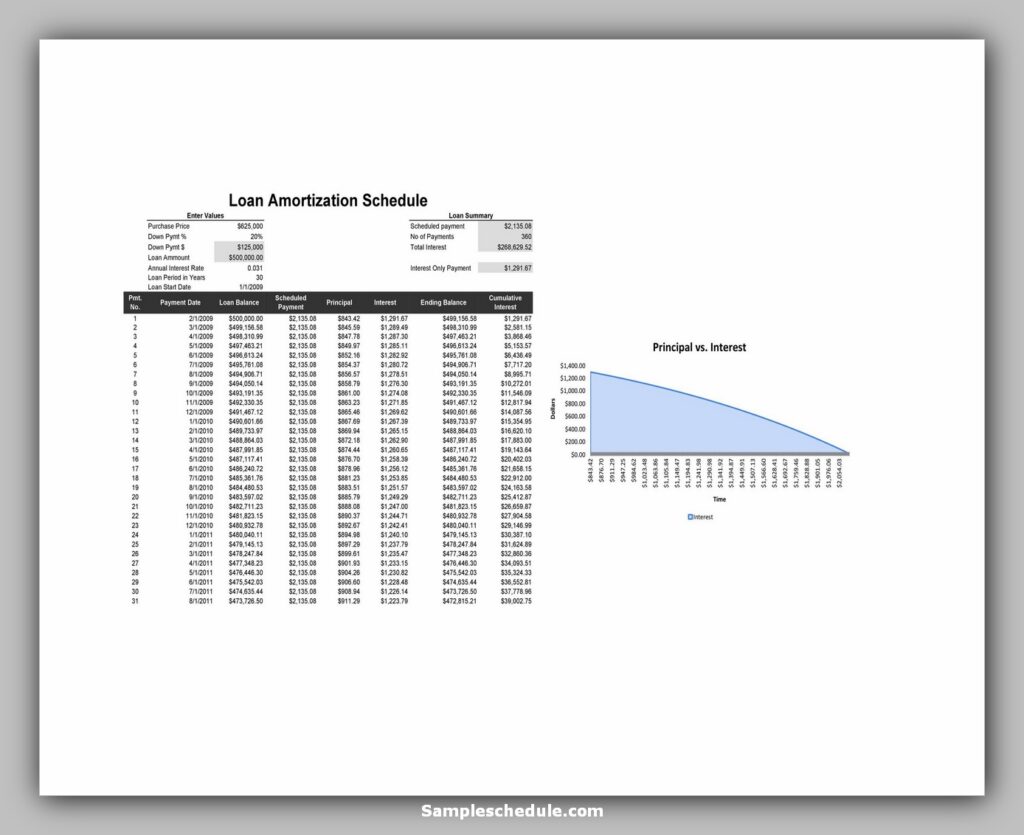

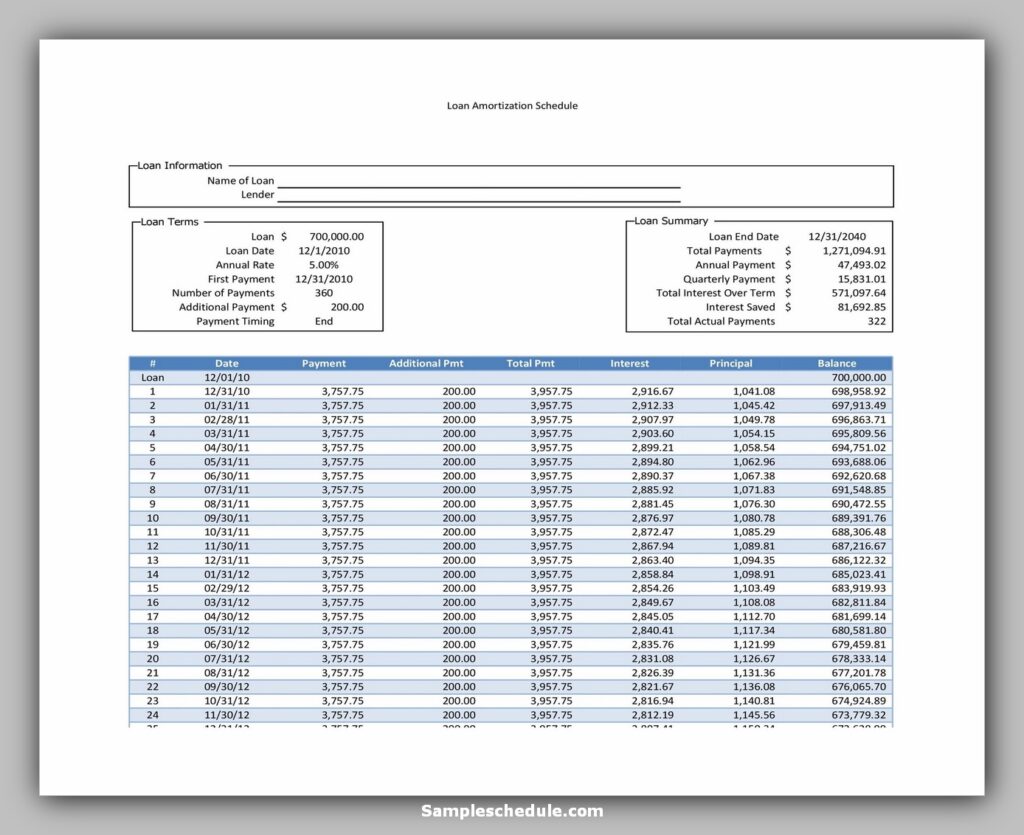

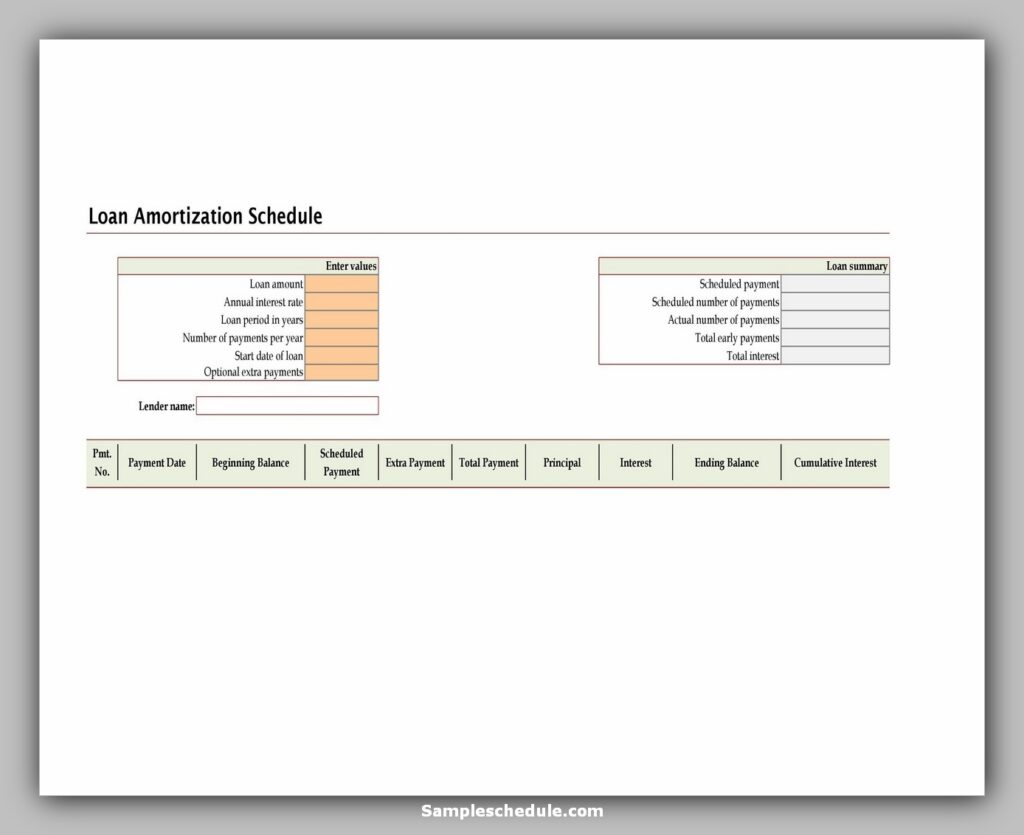

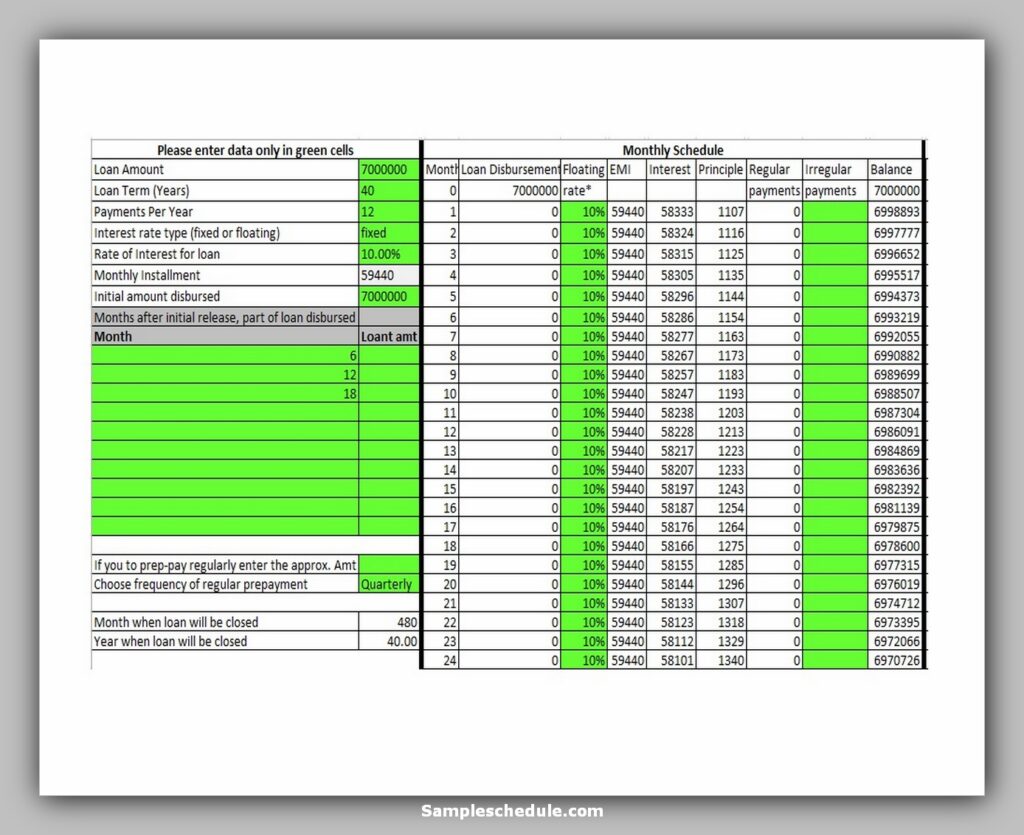

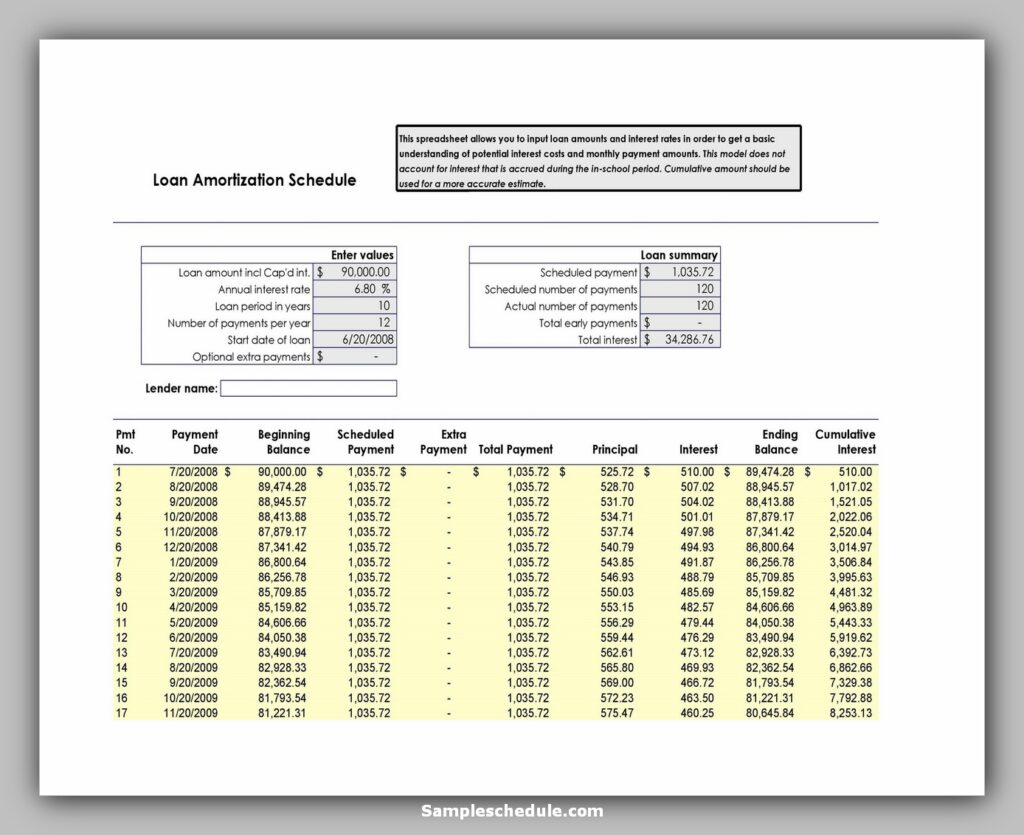

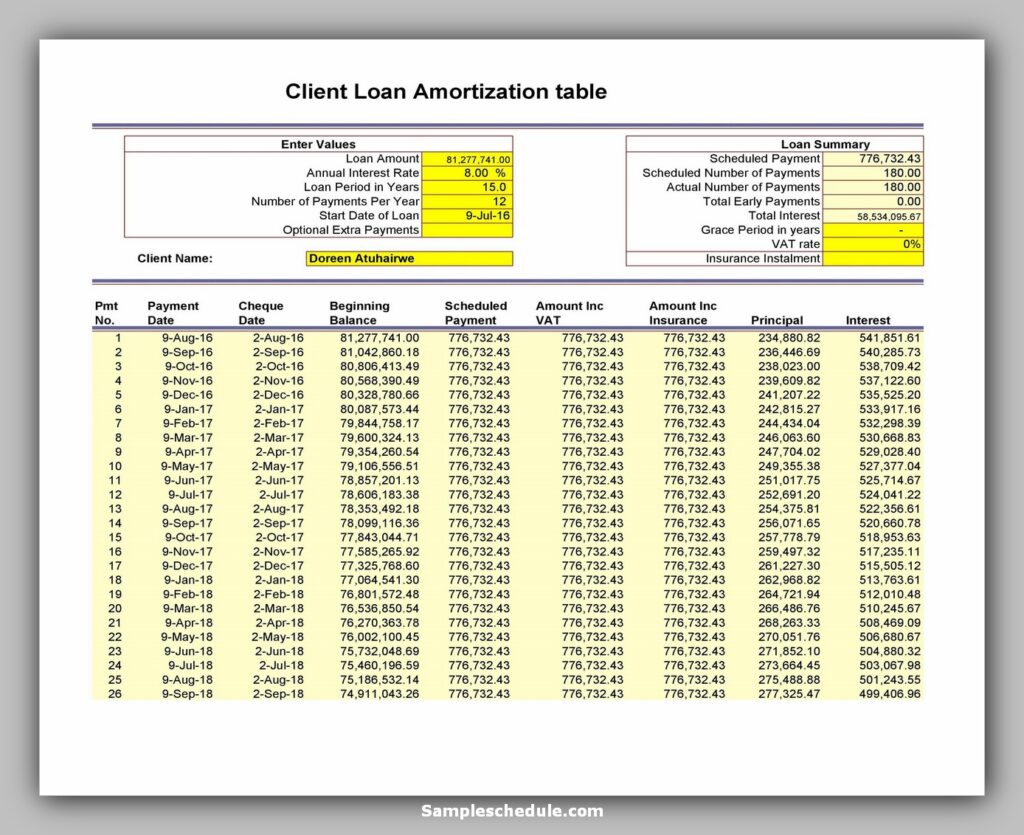

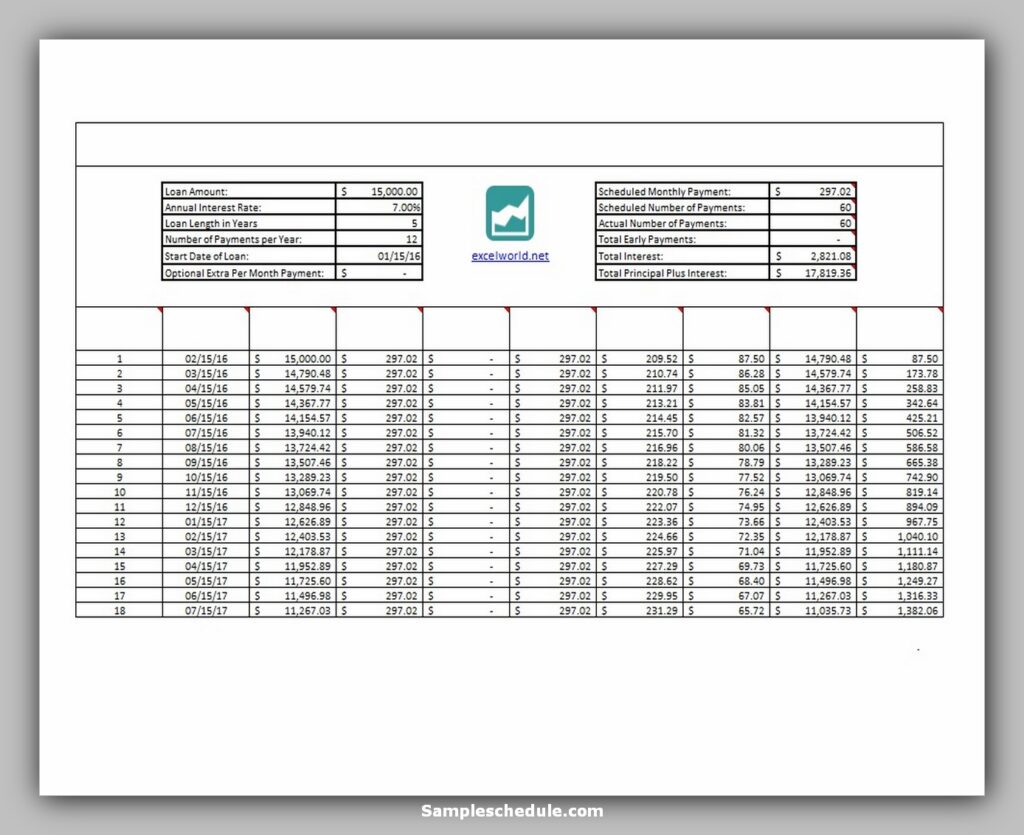

Another important factor to consider is downloading the loan amortization schedule excel. They have a ready-made template where you just have to fill in a few cells and your amortization amount and payment schedule will become a reality.

Another interest to take out a loan is to set your credit status. This is necessary in order to properly finance your activities. Good credit status amounts to lower interest rates, higher loan numbers, and higher confidence in financial institutions. For example, monitoring your payments is always necessary for a higher credit score.

What details do you need for a loan amortization schedule?

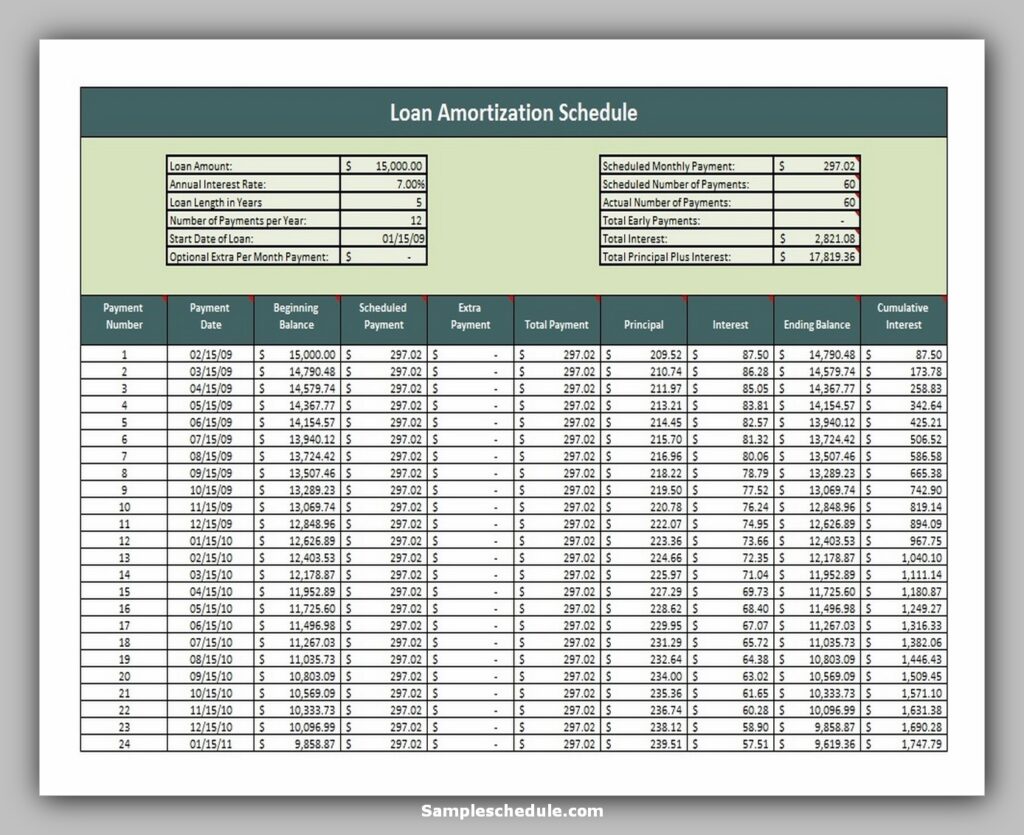

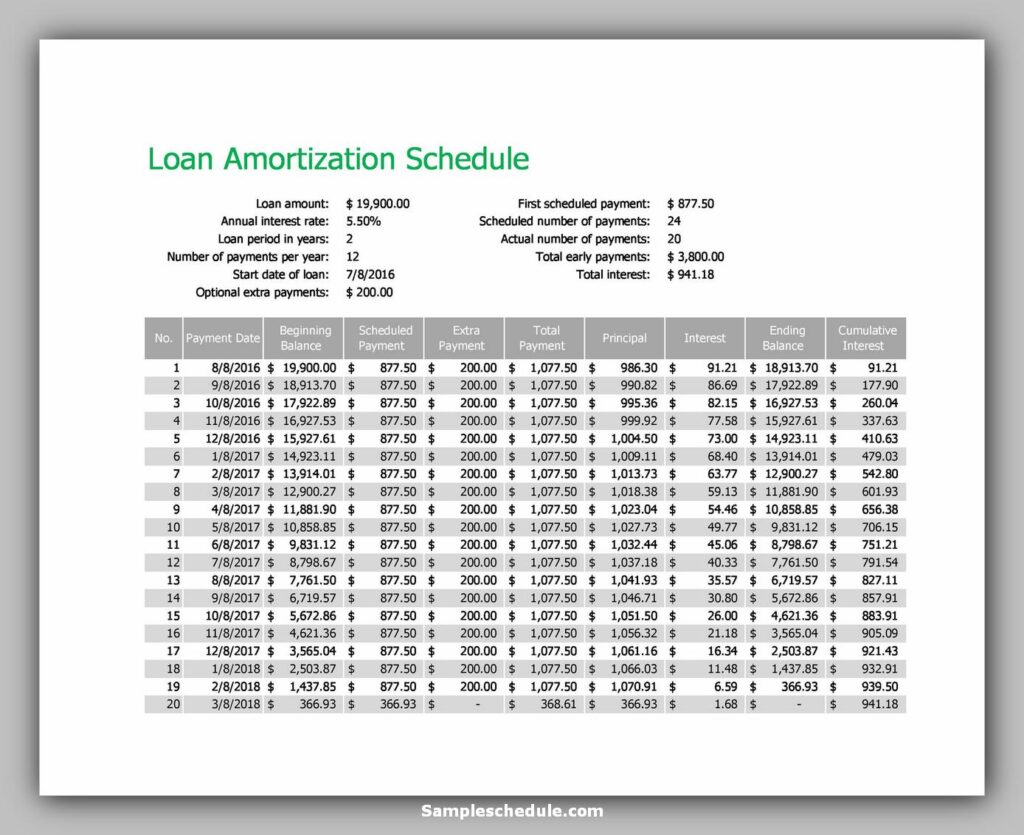

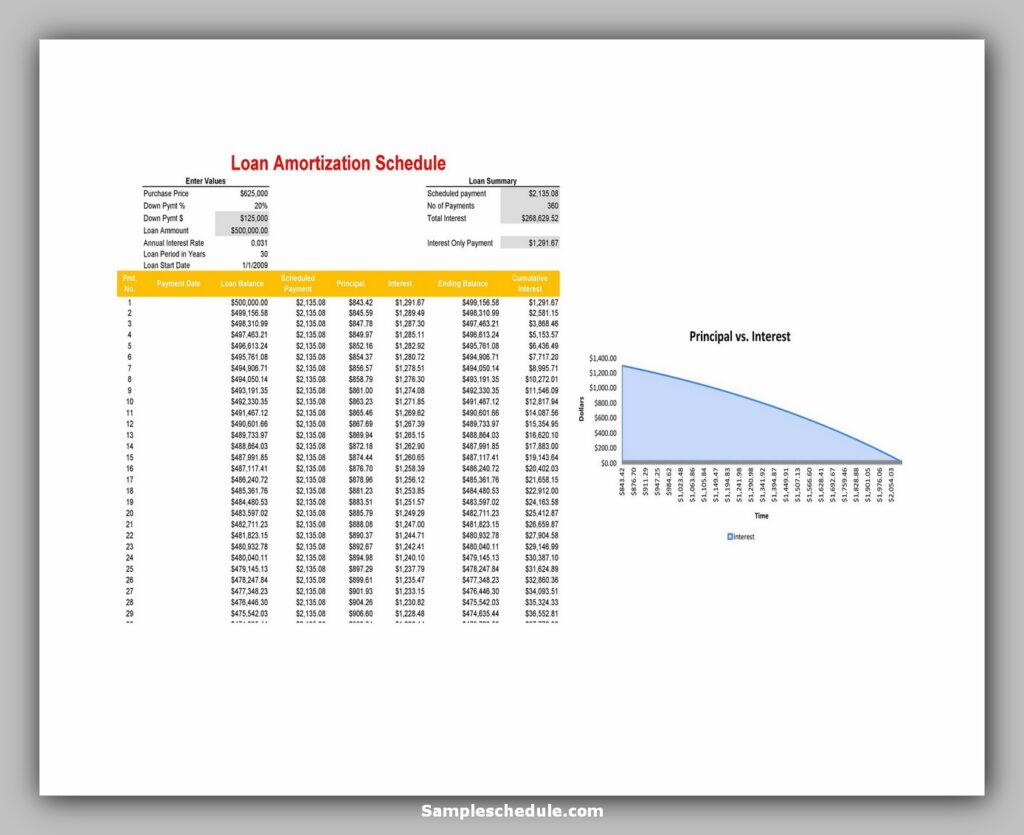

- Loan Amount

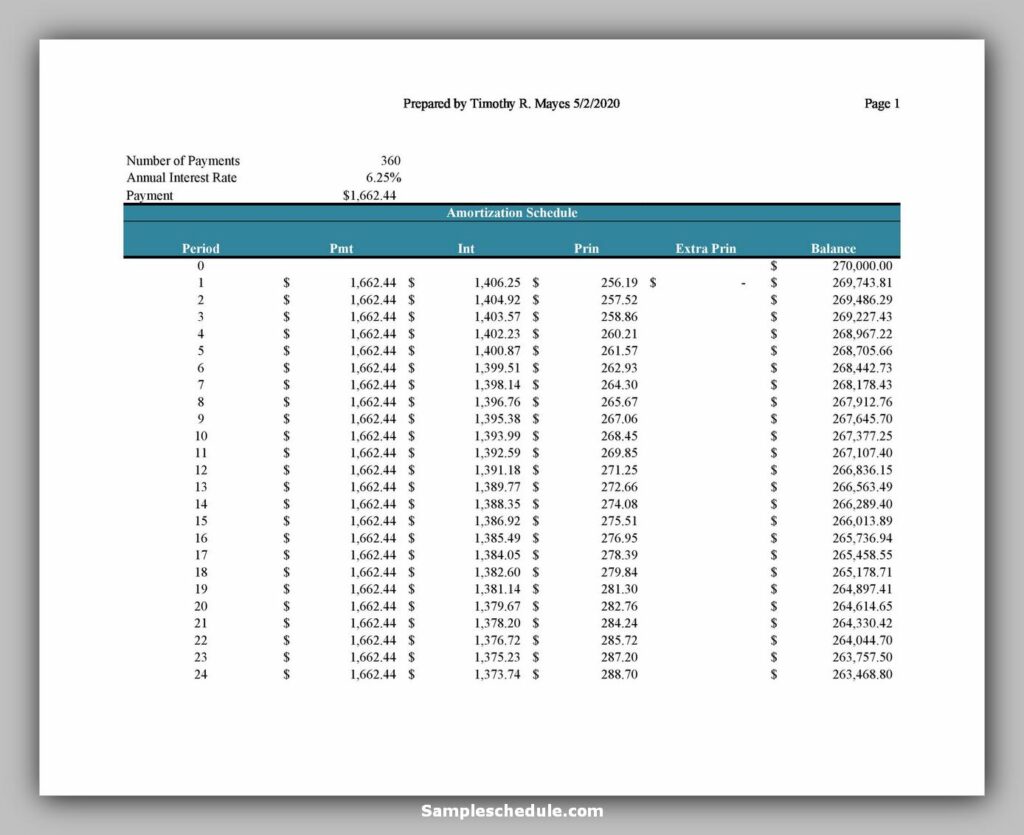

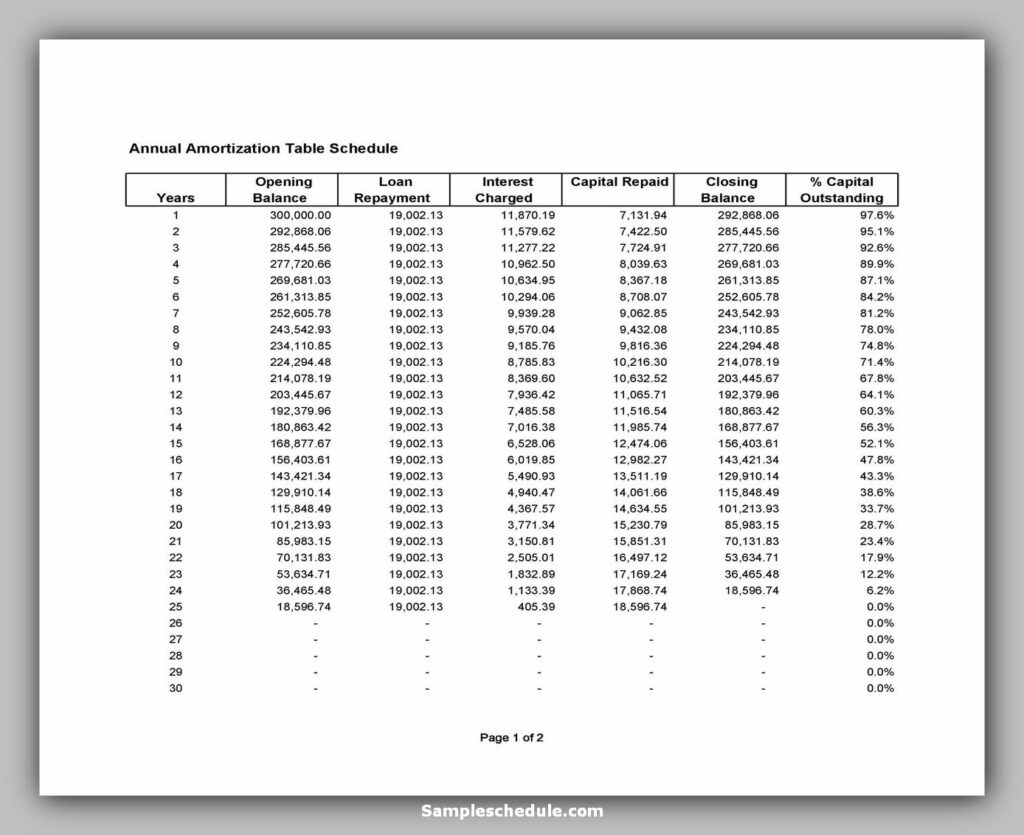

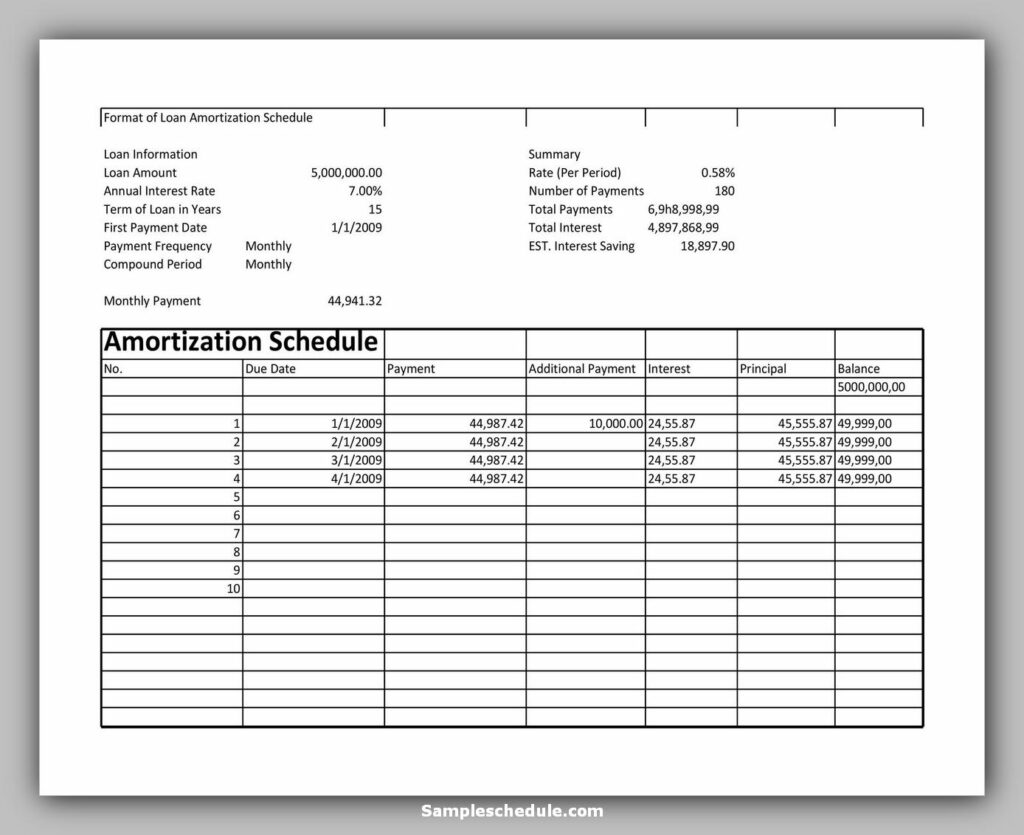

You apply for this amount and so you need to know how much amortization you need to repay that loan amount. There are cells in the loan amortization scheme to fill this amount. The template calculates the amortization schedule after you fill the highlighted cells.

- Annual interest

Your annual interest rate is usually based on your credit score. You need to know your annual interest rate to know your amortization schedule, so this cell needs to be filled in the template. If you do not know the annual interest rate applicable to your loan, you should check your contract or ask your lender for this information.

- Loan term in a few years.

This cell should be clear by the number of years you have to pay. It is important that the amortization schedule is filled with these details.

- Payment amount per year.

The loan amortization schedule should be calculated for the payment amount and schedule and so these are the important details you need to fill in.

- Loan start date.

This specifies the payment date and therefore it must be populated in the loan amortization schedule template.

After you fill in the cells associated with the important data listed above, the template fills in the payment amount, payment date, your current loan balance, and the planned payment.

You’ll also see in the template the amount applied to the principal and interest you paid.

The final balance that is your loan balance to apply the payment for the principal will be clear to you as well.

Cumulative interest rates are also automatically calculated in the loan amortization schedule template.

By having this monitor, you know when your payment is due and how much you have to pay. You also know how payments are applied and when you see that a higher amount is applied to the principal.

So, if you have extra money, you increase your payment to complete the previous loan. The loan amortization schedule will help you make sure you don’t miss a payment and understand where you’re on the payment schedule.

Excel has an out-of-the-box template that you download and therefore checks your loan correctly. By using this loan amortization schedule excel, you will be able to maintain good and faster creditworthiness, obtaining your future loans at better rates.

Loan Amortization Schedule Excel

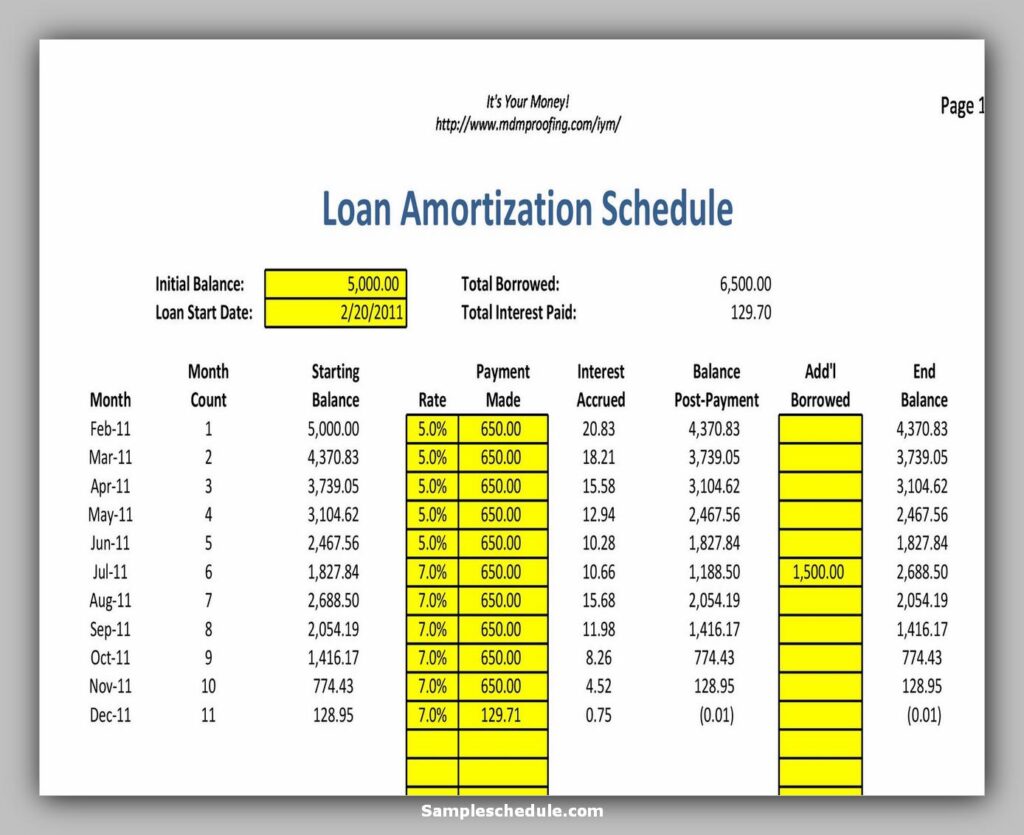

Loan Amortization Schedule Excel 01

Loan Amortization Schedule 27

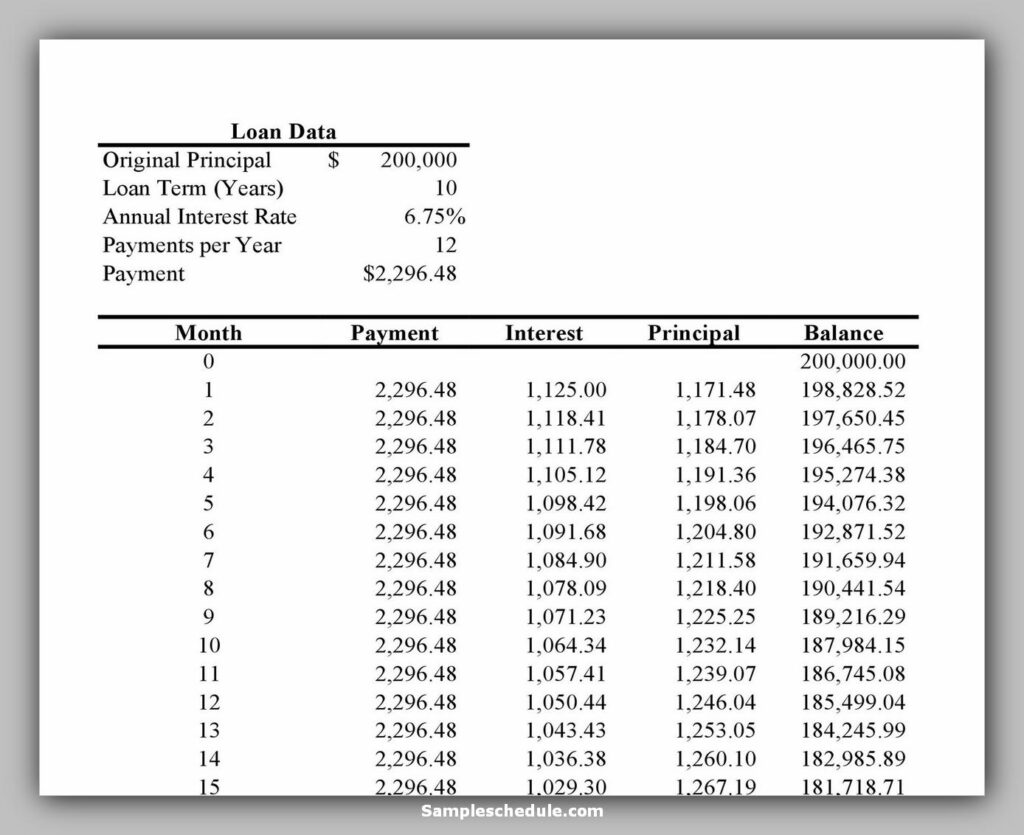

Loan Amortization Schedule 02

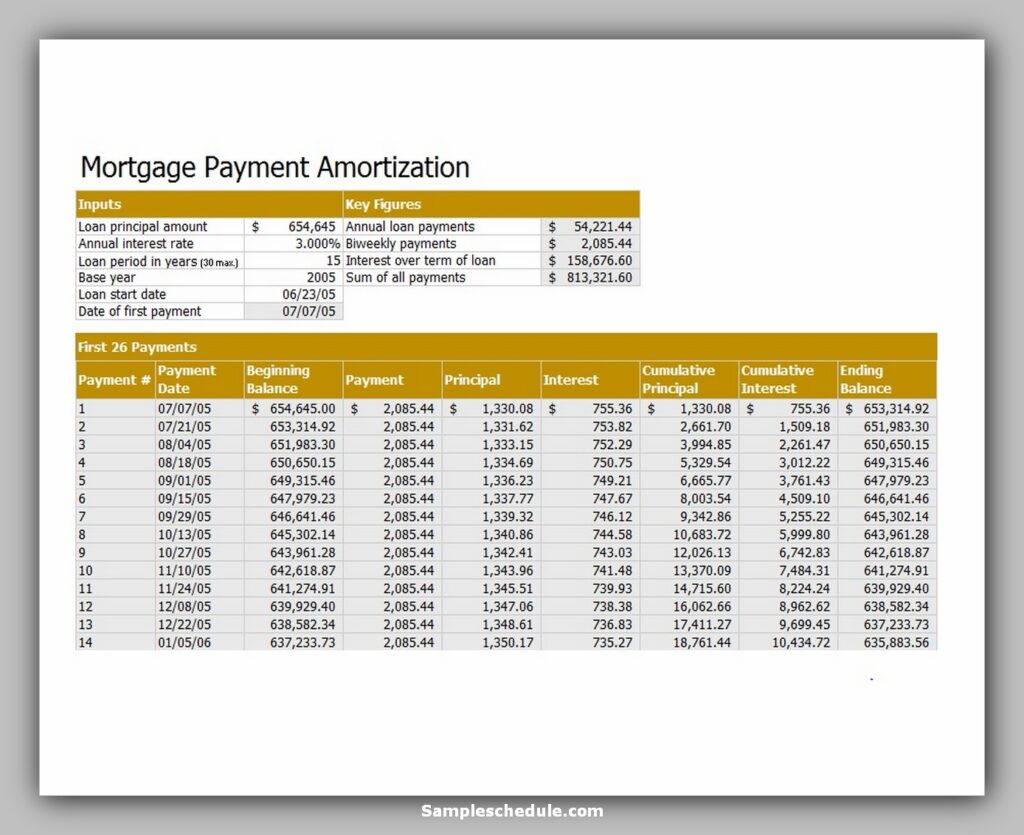

Loan Amortization Schedule 04

Loan Amortization Schedule 08

Loan Amortization Schedule 09

Loan Amortization Schedule 10

Loan Amortization Schedule 11

Loan Amortization Schedule 14

Loan Amortization Schedule 16

Loan Amortization Schedule 18

Loan Amortization Schedule 20

Loan Amortization Schedule 21

Loan Amortization Schedule 23

Loan Amortization Schedule 24

Loan Amortization Schedule 25

Loan Amortization Schedule 26